trading16

In the fast-paced world of Forex trading, keeping track of your trades and performance is essential for long-term success. This is where a forex trading journal app Vietnamese Trading Platforms comes into play. These apps not only help you record your trades but also provide insights into your trading patterns, strengths, and areas that need improvement. In this article, we’ll explore the significance of a Forex trading journal, the features to look for in an app, and how to effectively utilize it for your trading journey.

Why You Need a Forex Trading Journal

Forex trading can be both lucrative and risky. Without proper documentation of your trades, it becomes challenging to analyze your performance and make informed decisions. A Forex trading journal enables you to:

- Track Your Performance: Keeping a record of your trades allows you to evaluate your successes and failures, giving you a clear perspective on your overall performance.

- Identify Patterns: By reviewing past trades, you can uncover patterns in your trading behavior that may lead to improved strategies.

- Enhance Your Discipline: Documenting your trading decisions encourages accountability, making it easier to stick to your trading plan.

Key Features of a Good Forex Trading Journal App

When selecting a Forex trading journal app, various features can significantly influence your trading experience. Here are some essential features to consider:

- User-Friendly Interface: The app should have an intuitive design that makes it easy to input data and navigate through the various functions.

- Trade Entry and Exit Tracking: Look for an app that enables you to document the details of each trade, including entry and exit points, trade size, and reasons for entering trades.

- Performance Analytics: An app that provides analytical tools will help you interpret performance metrics, including win/loss ratio, average profit/loss, and drawdown statistics.

- Customizable Templates: The ability to customize journal templates can help reflect your trading style and strategies.

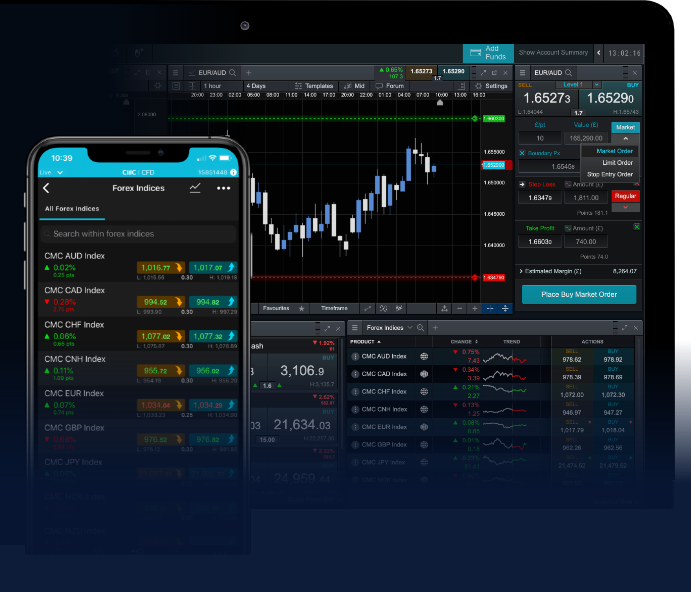

- Integration with Trading Platforms: Many traders use multiple platforms; an app that can integrate with your existing trading software will make data collection seamless.

- Cloud Backup: Ensure that your trading journal is backed up to the cloud. This provides security against data loss.

How To Use a Forex Trading Journal Effectively

Simply having a Forex trading journal app isn’t enough. To maximize its benefits, you need to use it effectively. Follow these steps:

- Set Clear Goals: Before you start trading, identify specific, measurable, achievable, relevant, and time-bound (SMART) goals for what you wish to accomplish with your trading.

- Document Every Trade: Consistency is key. Document all your trades, including the rationale behind each decision.

- Review Regularly: Schedule time to review your journal entries regularly. This can be weekly or monthly, but consistency is crucial.

- Analyze and Adjust: Based on your reviews, analyze how you can adjust your trading strategies to improve performance.

- Seek Feedback: If you are part of a trading community, consider sharing your journal with others to gain insights and feedback.

Conclusion

Investing in a Forex trading journal app is an investment in your trading future. By diligently tracking your trades and analyzing your performance, you can develop more effective trading strategies and enhance your overall success in the Forex market. With the features designed for your trading lifestyle and a structured approach to journaling your trades, you are not just documenting your journey; you are actively shaping your trading outcomes. Embrace the power of a Forex trading journal app and take the first step towards the disciplined trader you aspire to be.

Understanding Forex Trading Time Zones: Maximizing Your Success

The world of Forex trading is not just about strategy and analysis; it is also significantly influenced by time zones. Each of the major financial centers opens and closes at different times, creating a 24-hour trading environment. This unique characteristic of Forex trading necessitates an understanding of time zones to maximize your success. Whether you’re a novice or an experienced trader, knowing the right times to trade can help you capitalize on market movements and improve your trading performance. For more insights on trading in Uganda, consider exploring forex trading time zones Uganda Brokers.

The Basics of Forex Market Hours

The Forex market operates 24 hours a day, five days a week, allowing traders from around the globe to buy and sell currencies at various times. The market is divided into four major trading sessions: the Sydney session, the Tokyo session, the London session, and the New York session. Each of these trading sessions has its own unique characteristics and influences on currency volatility and price movements.

1. Sydney Session: The Calm Before the Storm

The Sydney session begins the trading week and is often quieter compared to other sessions. It opens at 10 PM GMT on Sunday and closes at 7 AM GMT on Monday. During this session, trading volume is generally lower, and major currency pairs tend to have narrower price movements. However, it does present opportunities for traders who want to act on news events or economic reports released in that region.

2. Tokyo Session: A Time of Increased Activity

The Tokyo session runs from 12 AM GMT to 9 AM GMT. As the Asian markets open, trading activity increases, especially for currency pairs that involve the Japanese yen. This session often sees a rise in volatility, and traders can benefit from the liquidity that comes from the reopening of the markets after the weekend. Economic releases from Asian countries can also greatly impact trading during this period.

3. London Session: The Most Active Trading Hours

The London session is known for its high trading volume and volatility. It opens at 8 AM GMT and closes at 5 PM GMT. This session overlaps with both the Tokyo and New York sessions, providing an optimal trading environment. Many traders consider the London session the «golden hours» of Forex trading, as it accounts for a substantial percentage of daily trading volume. Traders wishing to engage in serious currency trading activities should pay close attention to significant market events occurring during this time.

4. New York Session: The Final Push

As the final major trading session, the New York session runs from 1 PM GMT to 10 PM GMT. This session not only overlaps with the London session, which brings additional liquidity but also represents the closing of the day in the Forex market. Key economic data from the United States is often released during this time, leading to increased market activity and potential trading opportunities. Many traders use the news releases coinciding with the New York session to make informed trading decisions.

The Importance of Time Zone Awareness

Understanding the different Forex trading time zones is essential for every trader. Knowing when major sessions overlap allows you to take advantage of increased market volatility, as this is often when currency pairs experience more significant price swings. Additionally, trading during overlapping sessions can potentially lead to greater opportunities for profit, as more participants are actively trading.

Each trading session has its own characteristics based on factors like trading volume and economic releases. Being aware of these aspects helps traders plan their strategies more effectively. For beginners, experimenting with different trading times can also help in identifying when they feel most comfortable and successful.

Maximizing Profits by Timing Your Trades

To maximize profit, traders need to develop a trading schedule that aligns with the most active market hours. Here are a few strategies for trading across different sessions:

1. Use a Trading Calendar

A trading calendar that highlights important economic events can be a valuable tool for traders. By knowing when significant data releases are scheduled, traders can prepare and position themselves accordingly. Watching for these events is especially crucial during the London and New York sessions, when volatility typically spikes.

2. Employ Technical Analysis

Incorporating technical analysis into your trading strategy can provide insights into price movements during different sessions. Patterns may emerge that can inform buying and selling decisions, especially when sessions overlap. Being able to identify these patterns will help traders make more informed decisions based on the increased liquidity and volatility characteristic of specific times.

3. Mind the Time Zone Conversions

For traders who live in different time zones, knowing how to convert local time to GMT is crucial. This knowledge helps you effectively plan trades and avoid missing opportunities. Using GMT as a standard point of reference allows for easier communication and tracking of trading times.

Conclusion: Timing is Everything in Forex Trading

In conclusion, the significance of time zones in Forex trading cannot be overstated. Each session offers distinct trading opportunities based on volatility, market behavior, and economic events. Understanding these time zones enables traders to optimize their strategies and improve trading outcomes.

By being informed and planning your trading activities around the major sessions, you increase your chances of capitalizing on favorable market conditions. Whether you are trading in Uganda or anywhere else, keep your trading hours aligned with the market’s rhythm, and you’ll find yourself better positioned to succeed in the dynamic world of Forex trading.